The Ultimate Guide To Feie Calculator

The Best Guide To Feie Calculator

Table of ContentsFeie Calculator Can Be Fun For EveryoneThe Ultimate Guide To Feie CalculatorTop Guidelines Of Feie CalculatorExcitement About Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Talking About

He marketed his United state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his spouse to help accomplish the Bona Fide Residency Examination. Neil points out that buying home abroad can be testing without initial experiencing the place."It's something that people require to be actually persistent about," he states, and encourages expats to be careful of usual mistakes, such as overstaying in the United state

Neil is careful to mindful to Anxiety tax authorities tax obligation "I'm not conducting any business in Illinois. The U.S. is one of the few countries that taxes its citizens no matter of where they live, meaning that also if a deportee has no revenue from U.S.

tax return. "The Foreign Tax Credit history permits people working in high-tax countries like the UK to offset their United state tax liability by the quantity they have actually currently paid in taxes abroad," states Lewis.

Some Ideas on Feie Calculator You Need To Know

Below are several of the most frequently asked inquiries concerning the FEIE and various other exemptions The Foreign Earned Earnings Exclusion (FEIE) permits united state taxpayers to exclude approximately $130,000 of foreign-earned income from government income tax obligation, lowering their united state tax obligation. To get FEIE, you should meet either the Physical Visibility Examination (330 days abroad) or the Bona Fide Residence Examination (show your primary residence in a foreign nation for an entire tax year).

The Physical Presence Test likewise calls for U.S (Digital Nomad). taxpayers to have both an international revenue and a foreign tax home.

The Basic Principles Of Feie Calculator

A revenue tax obligation treaty in between the united state and an additional country can aid avoid double taxes. While the Foreign Earned Revenue Exemption reduces taxable income, a treaty might supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for declare U.S. citizens with over $10,000 in foreign monetary accounts.

Eligibility for FEIE depends on meeting certain residency or physical visibility tests. is a tax obligation advisor on the Harness system and the creator of Chessis Tax. He is a participant of the National Organization of Enrolled Agents, the Texas Culture of Enrolled Professionals, and the Texas Culture of CPAs. He brings over a years of experience helping Large 4 firms, suggesting expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax obligation consultant on the Harness platform and the creator of The Tax obligation Guy. He has more than thirty years of experience and currently concentrates on CFO services, equity compensation, copyright taxation, cannabis taxation and divorce relevant tax/financial planning matters. He is an expat based in Mexico - https://www.find-us-here.com/businesses/FEIE-Calculator-Atlanta-Georgia-USA/34329836/.

The international gained income exemptions, occasionally referred to as the Sec. 911 exemptions, exclude tax obligation on salaries earned from working abroad. The exclusions comprise 2 parts - an earnings exclusion and a housing exclusion. The following FAQs go over the benefit of the exclusions consisting of when both spouses are deportees in a basic fashion.

Not known Details About Feie Calculator

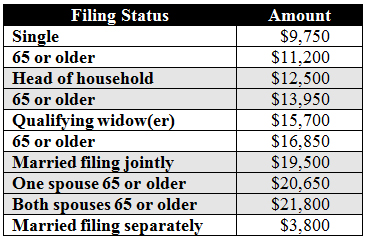

The earnings exemption is now indexed for inflation. The optimal yearly revenue exclusion is $130,000 for 2025. The tax obligation advantage omits the income from tax at lower tax obligation rates. Formerly, the exclusions "came off the top" minimizing earnings subject to tax obligation at the leading tax rates. The exclusions may or may not minimize revenue utilized for other objectives, such as individual retirement account restrictions, youngster credit histories, personal exemptions, and so on.

These exclusions do not excuse the earnings from US taxation yet simply offer a tax reduction. Note that a single individual functioning abroad for all of 2025 that made about $145,000 with no blog here various other earnings will have taxable earnings reduced to absolutely no - efficiently the same solution as being "tax obligation complimentary." The exclusions are calculated on a day-to-day basis.